Aluminum monthly report: spring back to the floor heating, March aluminum prices or first rise and then fall

- Categories:Industry Info

- Author:

- Origin:

- Time of issue:2018-05-09

- Views:97

(Summary description)Fubao Information March 3 News:

Core tip: this month Lunalu constantly refresh a record high, and the rising trend intact; Shanghai aluminum is suppressed by high inventory, but the shock is strong trend unchanged, aluminum prices are expected to rise in March and then fall, Lunalu aluminum fluctuation range of $1850-2000; Shanghai aluminum main fluctuation range of 13,500-14,500 range; East China spot aluminum fluctuates in 1.34- 14,200, it is suggested that bargains can be appropriate procurement.

Aluminum monthly report: spring back to the floor heating, March aluminum prices or first rise and then fall

(Summary description)Fubao Information March 3 News:

Core tip: this month Lunalu constantly refresh a record high, and the rising trend intact; Shanghai aluminum is suppressed by high inventory, but the shock is strong trend unchanged, aluminum prices are expected to rise in March and then fall, Lunalu aluminum fluctuation range of $1850-2000; Shanghai aluminum main fluctuation range of 13,500-14,500 range; East China spot aluminum fluctuates in 1.34- 14,200, it is suggested that bargains can be appropriate procurement.

- Categories:Industry Info

- Author:

- Origin:

- Time of issue:2018-05-09

- Views:97

Fubao Information March 3 News:

Core tip: this month Lunalu constantly refresh a record high, and the rising trend intact; Shanghai aluminum is suppressed by high inventory, but the shock is strong trend unchanged, aluminum prices are expected to rise in March and then fall, Lunalu aluminum fluctuation range of $1850-2000; Shanghai aluminum main fluctuation range of 13,500-14,500 range; East China spot aluminum fluctuates in 1.34- 14,200, it is suggested that bargains can be appropriate procurement.

I. Fundamental analysis

1. The supply and demand analysis

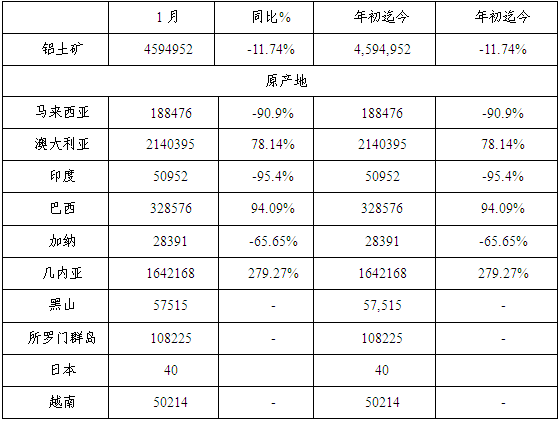

(1) China's bauxite imports in January 2017 decreased by 11.74% year-on-year

Table 1: China's bauxite imports in January

China imported about 4.595 million tons of bauxite in January, down 11.74 percent year on year, according to customs data. Among them, the import of bauxite from Australia in January was about 2.14 million tons, an increase of 78.14% year-on-year, becoming the first importer of bauxite in China in January. Imports of bauxite from Malaysia in January were about 188,000 tons, down 90.9 percent year on year. In January, the import of bauxite from Guinea was 1.64 million tons, up 279.27% year on year; Separately, Guinea's mining minister said that to meet China's demand for bauxite, the country is expected to produce more than 60 million tons of high-grade bauxite in 2020.

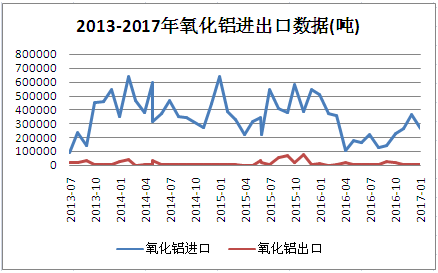

(2) In January 2017, China's alumina imports decreased by 47.64% year-on-year and 27.4% month-on-month

Figure 1 Comparison of import and export of alumina in China from 2013 to 2017

Chinese customs data showed that alumina imports in January were about 268,000 tons, down 47.64% year on year, of which 147,000 were imported from Australia, accounting for 54.9%. In terms of exports, China exported 5,386 tons of alumina in January, down 61.59% year on year.

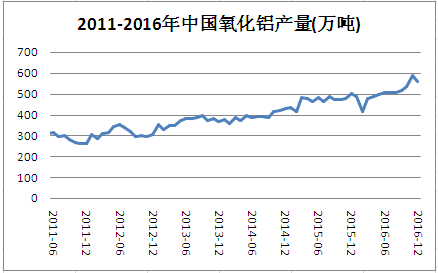

Figure 2: Comparison of alumina production in China from 2011 to 2016

As of the end of February 2017, China's alumina production for January has not yet been announced. In December 2016, the monthly output of alumina in China was 5.614 million tons, up 12.24% year on year, and the annual cumulative output was 608.27 million tons, up 7.93% year on year. It is also reported that China's alumina production capacity is expected to reach 6 million tons in 2017, and the total production capacity is expected to reach 80 million tons. Based on the average operating rate of 82% this year, the output is expected to reach 65.6 million tons in 2017, up 9.2% year on year.

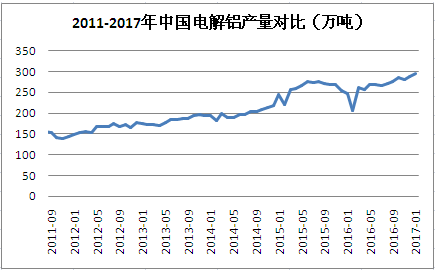

(3) China's primary aluminum output in January was 2.95 million tons, up 2.04 percent month-on-month

Figure 3 Analysis chart of China's electrolytic aluminum output from 2011 to 2017

China's primary aluminum (electrolytic aluminum) output in January was 2.95 million tons, up 16.6 percent from the same period last year. Global primary aluminium production, excluding China, was 2.168 million tonnes in January, down from 2.171 million tonnes in December.

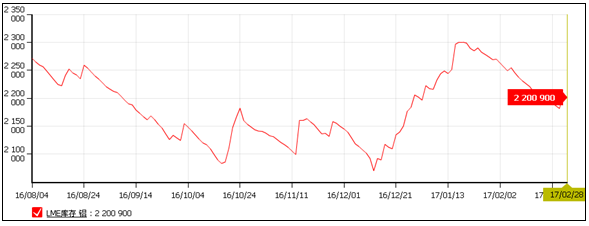

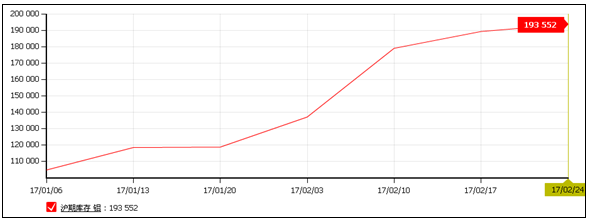

(4) Inventory of London Aluminium and Shanghai Aluminium

Figure 4: LME aluminum inventory

Figure 5: Aluminium inventory on Shanghai Stock Exchange

On the contrary, since the Spring Festival, Shanghai aluminum inventory has been in a growing trend. Due to the Spring Festival holiday, the market demand turned weak, resulting in a large increase in inventory. As of February 24, Shanghai aluminum inventory has reached 193,552 tons, up 75,001 tons compared with a year ago, an increase of 63%.

(5) Fubao survey

This month continue to investigate the start of electrolytic aluminum in various regions, according to the investigation, the Lantern Festival market has been started, in addition to Shandong, Xinjiang region to maintain a high rate of operation, that is, Shandong 96%, Xinjiang 94%; The operating rate of other regions is still insufficient, the operating rate of Henan is only 70%; Xinjiang high rate of operation, also make the market inventory squeeze, after the holiday in East China, South China market goods increased significantly, currently Shanghai aluminum ingot inventory has been as high as 210,000 tons, the South China Sea aluminum ingot inventory as high as 250,000 tons.

Production, recently because of xuanhua explosion accident in xinjiang, the xinjiang autonomous region government requires enterprises in xinjiang to strengthen production safety management, to not require completion and production of aluminum rod production enterprise production safety relative formalities, for opening soon caused a certain influence, starting time is delayed, the impact is not big but have started construction of enterprise. In addition, some areas of Guangdong once again encountered environmental inspection, remelting aluminum rod factory operating rate dropped sharply, the market operating rate only maintained at about 60-70%.

Second, spot market analysis

1. Spot price analysis

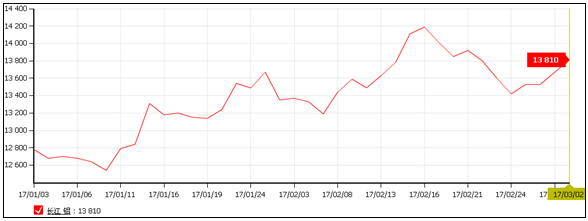

Figure 6: East China spot aluminum prices in February chart

East China: Environmental protection to reduce production capacity speculation continues to fermentation, aluminum prices began to rise in a big wave, continued to the 16th, the Yangtze River spot aluminum ingot broke through 14,000 yuan, the highest to 14,210 yuan/ton, then fell back, although at the end of the month to regain part of the decline, but still not stand 14,000, a monthly increase of 1.35%, as of March 3, Yangtze River spot aluminum ingot price in 13690-13730 yuan/ton.

In the spot market, at the beginning of February, merchants did not fully enter the market, the demand is poor, coupled with the price continues to rise, the downstream enterprises fear high obviously, the market receiving volume is limited, with the Lantern Festival after the downstream small and medium-sized enterprises enter the market, the market turnover picked up, middlemen moving goods more actively, the market turnover in February gradually improved.

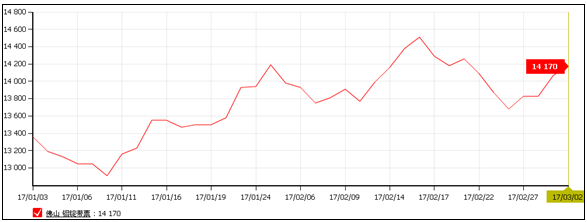

Figure 7: Foshan spot aluminum prices in February chart

South China region: different from the East China region aluminum ingot rising market, in February south China region appeared to slide phenomenon, as of the end of February, South China aluminum ingot with ticket price between 13780-13880 yuan/ton, down 360 yuan/ton compared to the end of January, the highest to 14560 yuan/ton, the lowest to 13630 yuan/ton. In February, the South China market shipper shipments are relatively positive, downstream enterprises to stock up on demand.

2. Scrap market

Table 2: Scrap aluminum price statistics in some areas (unit: yuan/ton)

In February, the overall price of scrap aluminum rose slightly compared with January, and the range was around 200 yuan/ton. Miluo profile aluminum and Chongqing aluminum alloy material fluctuated greatly during the Spring Festival, and the price rose significantly. By the end of the month, Miluo 9700-9900 yuan/ton and Chongqing alloy white material were around 11,000yuan. South China clean machine raw aluminum market mainstream price in the vicinity of 10100 yuan/ton.

Market clinch a deal, in early February factor influence because of the holiday is not over, clinch a deal the cold and cheerless, receiving significant market is not much, as the post-holiday merchants in the market, receiving business increase, prices also boosted recyclers shipment, aluminium scrap market merchants in February delivery mood is higher, the market supply of goods, especially at the end of henan greiner, aluminium wire supply increased, Recycled aluminium smelters stock up on demand.

Environmental protection, February 15 began, a new round of environmental supervision began, the current more severely affected is the Beijing-Tianjin-Hebei region, small and medium-sized smelting enterprises shut down seriously, in the manufacturer to receive goods more choose to reduce prices.

Aftermarket forecast: with the arrival of the peak season, scrap aluminum demand gradually improved, the price or stable medium and small rise, but in March there are risk factors of the Federal Reserve interest rate rise, is expected to rebound space is limited, it is suggested that recyclers fast in and fast out operation.

III. Technical analysis

Figure 8: London Aluminium Market Chart

After rebounding from the bottom of $1676.5 in early January, the London Aluminium extended its upward trend all the way. In February, it kept breaking new record highs, breaking through the $1900 mark intraday at one fell swish, and maintaining the support of this mark. By March 2, the London Aluminium Aluminium climbed to the highest $1957, a new high in 26 months. Lunalu or hit a new high in March, the top attention to the $2000 mark pressure level.

Figure 9: Shanghai aluminum main market chart

Earlier this month at the New Year at the start of the Shanghai aluminum in Aaron, usher in a wave of rallies, highest rebound until 14580, however, due to the increased after the arrival of the goods market, and for the fed to raise interest rates expected to heat up, rising prices, then, go all the way to recovery after 13505, below the 13500 a line support, technically, two sessions held in March, Environmental rectification strictly can make aluminum to heat up, the environmental protection of the heating period of four provinces of north China limited energy intensive high pollution industry approved by exposure, environmental production hype are confirmed, from the point of trend, Aaron aluminum innovation is high, and rising trend in good condition, the Shanghai aluminum is subject to inventory pressure, moves slightly weak, but the overall shock strong trend remains unchanged, pressure 14500 top concern. Beware of aluminum price drop after the middle of the month.

IV. Market outlook and operational suggestions

Good U.S. economic data boosted, Aaron aluminum constantly refresh record high this month, dish in every break through the $1900 mark, and the mark for the support, by the end of March 2, Aaron aluminum climbed to $1957, the highest record of 26 months, technically, rising short-term Aaron aluminum shape intact, march Aaron aluminum or hit a record high, focus on $2000 above the threshold pressure.

Shanghai aluminum is subject to inventory pressure, slightly weak trend, but the overall shock is strong trend unchanged, Shanghai aluminum rose first and then fell, Shanghai aluminum main at the beginning of the month to the highest above 14500, then went down, the lowest to 13505, lower 13500 line support is obvious, technically, in March, the two sessions will be held, environmental protection will strictly make aluminum prices rise, It is reported that the Ministry of Environmental Protection on the four provinces of North China heating season limit high energy consumption and high pollution industry approval was exposed, environmental protection production speculation has been confirmed, from the trend point of view, London aluminum continues to break new highs, and the rising trend is good, Shanghai aluminum shock strong trend unchanged, the top attention to 14500 pressure level. Beware of aluminum price drop after the middle of the month.

Therefore, we expect aluminum prices to rise first and then fall in March, with a range of $1850-2000; Shanghai aluminum main fluctuation range of 13,500-14,500 range; East China spot aluminum fluctuates in 1.34- 14,200, it is suggested that bargains can be appropriate procurement.

Scan the QR code to read on your phone

Quick navigation

Contact us

Address: No.11, Yangtai Road, Yanghe Industrial New District, Yufeng District, Liuzhou, Guangxi Zhuang Autonomous Region

Email: liulvgm@alzco.com.cn

Tel: 0772-3511420

Fax: 0772-3166032

Guangxi Liuzhou Yinhai Aluminum Co., Ltd 桂ICP备15007883号 BY:300.CN

Guangxi Liuzhou Yinhai Aluminum Co., Ltd 桂ICP备15007883号 BY:300.CN